Starting an online store is an exciting venture, but one critical aspect that can make or break your e-commerce success is the choice of payment gateways. Payment gateways are the virtual cashiers of your online store, responsible for processing transactions securely and efficiently. With numerous options available, selecting the right payment gateway is a decision that requires careful consideration. Just like a physical cash register, it’s vital for payment gateways to be secure and user-friendly. Before choosing one, understanding their operation, key features, and available options is essential.

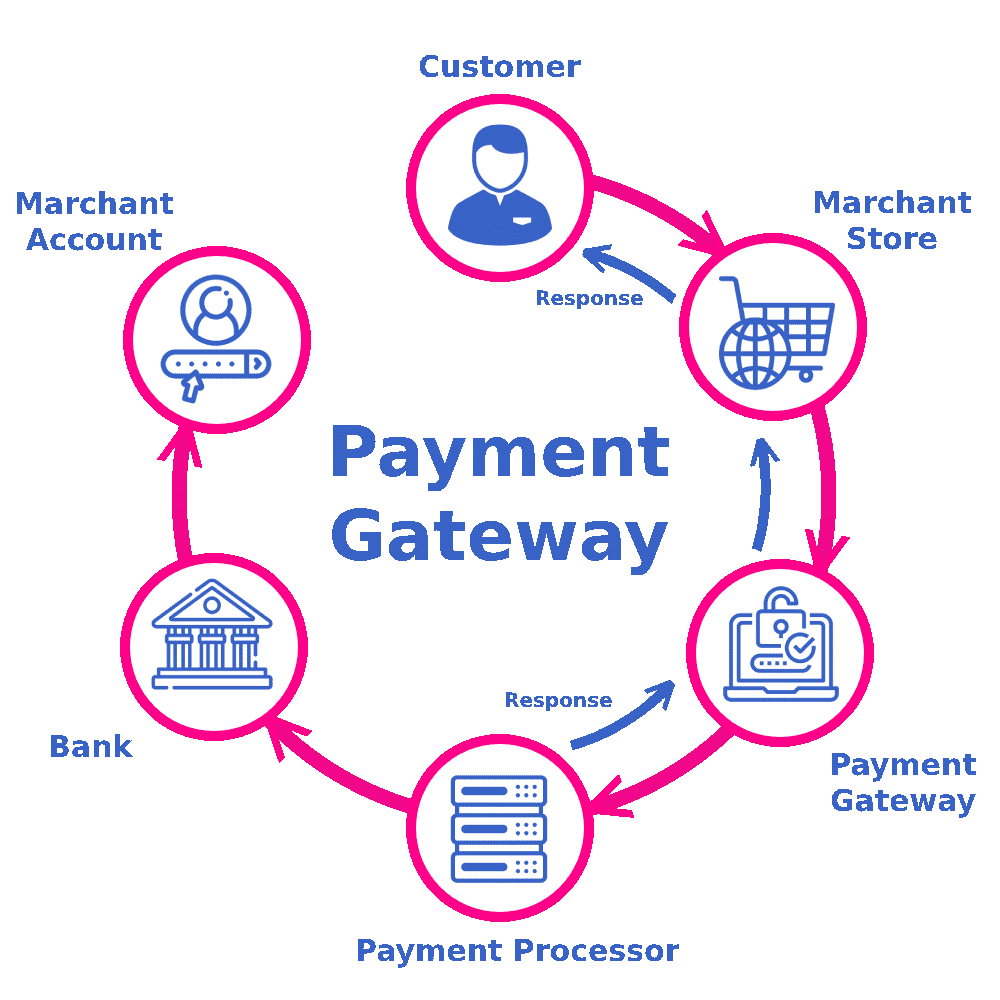

Understanding Payment Gateways

Payment gateways are the digital bridges that connect your online store to the financial networks that process payments. When a customer makes a purchase on your website, the payment gateway securely collects payment information, verifies it, and transfers the funds from the customer’s account to yours. This process must be seamless, reliable, and, most importantly, secure to protect both you and your customers.

Top Payment Gateway Options

Amidst the plethora of options, choosing the right payment gateway can be daunting. With varying pricing, transaction fees, and features, making an informed choice is vital. Here we will explore some of the most popular and reliable payment gateways available for your online store:

1. PayPal

PayPal is one of the most recognized and widely used payment gateways globally. It offers a secure and easy-to-integrate solution for e-commerce businesses. With PayPal, customers can pay using their PayPal accounts or credit/debit cards, making it a versatile choice. One of its primary advantages is its ability to enhance checkout conversion rates significantly. Customers worldwide trust PayPal, with a substantial percentage feeling more secure when shopping at merchants that accept it. Additionally, PayPal employs advanced fraud detection and seller protection measures to minimize claims and chargebacks. Whether for large enterprises or small businesses, PayPal offers scalability and global expansion opportunities, making it a reliable choice for businesses of all sizes.

Pros:

· Recognizable and trusted by customers.

· Global reach with support for various currencies.

· Quick and easy setup.

Cons:

· Transaction fees may be higher than other options.

· Limited customization options for the checkout process.

· Support can be slow, often a 24-hour email service

· Notorious for holding funds from sellers and account closures with little recourse

2. Stripe

Stripe is a developer-friendly payment gateway that offers a range of customization options. It allows you to integrate payment processing directly into your website, giving you more control over the user experience. It caters to various sectors like mobile ecommerce, SaaS, non-profits, and platform-based payments.

Stripe’s versatility extends to in-person payments through its Stripe Terminal, making it a preferred choice for businesses seeking customizable payment solutions and international payment processing. Its strength lies in its

adaptability, offering a suite of tools rather than a one-size-fits-all solution. It seamlessly integrates with websites through user-friendly APIs and pre-built options for platforms like Shopify and WooCommerce. Stripe constantly

evolves, introducing new features annually, ensuring flexibility in supporting mobile payments, subscription billing, and streamlined checkouts.

Pros:

· Extensive customization options.

· Supports various payment methods, including credit/debit cards, digital wallets, and more.

· Transparent pricing with no setup fees.

· Developer-friendly

Cons:

· May require some technical expertise to set up.

· Transaction fees can vary depending on your location.

· No native inventory management

3. Square

Square is known for its simplicity and ease of use. It’s a great choice for small to medium-sized businesses. Square provides not only online payment processing but also in-person payment solutions. It offers a robust payment gateway that covers invoicing, subscription setups, and international transactions. What sets Square apart are its additional features, including customer relationship tools, employee management, inventory management, and detailed reporting, aiding businesses in holistic management. While Square caters predominantly to small businesses requiring in-person credit card processing, it’s also a solid choice for expanding into online sales. Their ecommerce integration seamlessly links with their renowned POS system, making it a convenient choice for businesses planning both physical and online operations.

Pros:

· User-friendly interface.

· Offers a range of hardware for in-person payments.

· Predictable, flat-rate pricing.

· Best for retailers

· Buy now, pay later options for both in-person and online transactions

Cons:

· May lack advanced features required by larger businesses.

· Limited international support compared to other gateways.

· No phone support

· Limited customer support hours

4. Authorize.Net

Authorize.net is a well-established payment gateway available in over 33 countries and serves more than 400,000 customers globally. It is a long-established payment gateway known for its reliability and security. It enables retailers to accept payments through various processors and platforms, including PayPal, Apple Pay, and major credit cards. It’s suitable for businesses of all sizes and offers a range of features, including fraud detection and recurring billing.

Pros:

· Robust security features.

· Supports multiple payment methods.

· Suitable for international transactions.

Cons:

· Requires a monthly subscription fee in addition to transaction fees.

· The setup process might be more complex than some other gateways.

5. 2Checkout

2Checkout, now known as Verifone, is a leading global payment platform that enables businesses to accept online and mobile payments from customers around the world. It offers a variety of payment methods, including credit and debit cards, PayPal, and various local payment options, making it a versatile choice for international businesses. 2Checkout focuses on providing a seamless and secure payment experience for both merchants and customers. One of its strengths lies in providing a seamless customer checkout experience, and it integrates smoothly with 120+ online shopping carts. Moreover, 2Checkout ensures reliability, especially for expanding businesses eyeing global markets, handling aspects like global payments, subscription billing, and tax management.

It’s adaptable, allowing businesses to start with their immediate needs and scale up effortlessly.

Pros:

· Supports payments in multiple currencies and languages

· Offers a wide range of payment methods

· Easy Integration

· Robust security features

Cons:

· Transaction Fees

· Some users have reported occasional delays in receiving payouts

· Limited Customization

Factors to Consider When Choosing a Payment Gateway

Selecting the right payment gateway involves more than just looking at features and fees.

Here are some essential factors to consider:

Security: Ensure that the payment gateway is PCI DSS compliant to protect sensitive customer data. Look for SSL (Secure Socket Layer) encryption to protect data transmission between your website and the payment gateway. Also, look out for features like fraud detection and prevention mechanisms.

User Experience: A smooth and intuitive checkout process can reduce cart abandonment rates. Opt for gateways with user-friendly interfaces and that offer seamless mobile integration for a positive user experience on smartphones and tablets.

Fees: Understand the fee structure, including transaction fees, monthly fees, and any additional costs.

Supported Payment Methods: Consider the types of payments your customers are likely to use, such as credit cards, digital wallets, or bank transfers. For international customers, having bank transfer options can be beneficial. If you offer subscription services, ensure the gateway supports recurring billing.

International Support: If you plan to sell globally, choose a gateway that supports multiple currencies and

international transactions.

Integration: Check if the gateway easily integrates with your e-commerce platform or website. For customization, APIs (Application Programming Interfaces) are essential; verify their availability.

Customer Support: Reliable customer support is essential for resolving issues promptly.

Scalability: Ensure the gateway can scale with your business as it grows, accommodating increased transaction volumes.

In conclusion, selecting the right payment gateway for your online store is a decision that requires careful evaluation. Each payment gateway has its own set of features, fees, and considerations. By understanding your specific needs and considering the factors mentioned above, you can choose the payment gateway that best suits your online business, ensuring a secure and convenient payment experience for your customers.

Leave a Reply